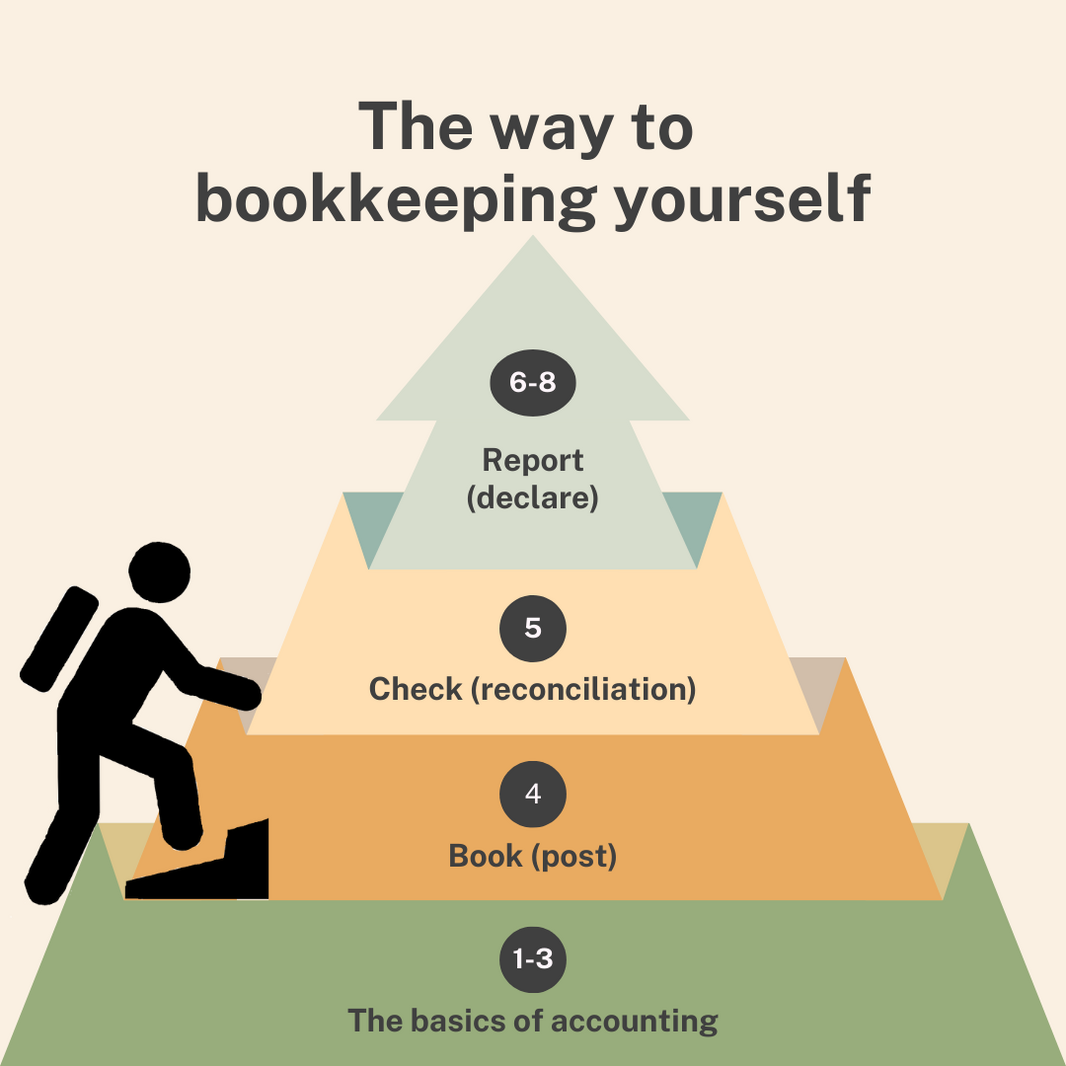

Bookkeeping training

Exampel of a training

Step 1

Step #1 The foundations of accounting

We go through how an accounting is laid out and what the various mandatory parts mean:

- Verifications, what a document should look like.

- Basic accounting, what order everything should come

- General ledger, how to get a structure

Preparation: Watch the video "How to do bookkeeping in Sweden"

Optionally instead of a meeting:

- see the the webbinar 7 easy steps to start bookkeeping to get the big picture of what your bookkeeping can be and

- see the Accounting Series from YouTube to know what you have registered and the meaning of it.

Step 2

Step #2 Structure of the chart of accounts

We go through how the BAS chart of accounts is structured, how to use it and translate your income and expenses into the language of accounting.

Preparation: Write a list of your income and expenses and divide into groups. Use your own words, for example:

|

Income |

Local |

Consumption |

IT-services |

Administration |

|

Consulting assignment |

Rent |

Office supplies |

Website |

Accounting |

|

Sales of products |

Cleaning |

Computer |

Office-package |

Consultant fees |

|

|

|

Desk |

|

|

Step 3

Step #3 Costs in the bookkeeping

Learn what is a deductible expense and what is not.

Take the online course: Costs in the bookkeeping

Step 4

Step #4 Book

We go through how to book a business event in accounting software of your choice.

Preparation: Choose the accounting software to use and prepare receipts, invoices and other documents for the accounting (verifications).

Step 5

Step #5 Reconciliation

We follow up on how it has gone and go through questions.

Preparation: Book, book, book

Step 6

Step #6 Account for VAT

Learn how to report, book and declare VAT.

Take the online course: Report VAT

Step 7

Step #7 Reports

We go through issues that have come up along the way and look at the various reports.

Preparation: Book a number of business events

Step 8

Step #8 Preliminary income tax

Learn how to calculate and pay the provisional income tax.

Take the online course: Preliminary income tax

Step 9

Step #9 Pay salary (only for limited companies or employers)

Learn how to calculate, report and declare salary payments in the employer's tax return, using the Tax Agency's free tool.

Take the online course: English online course underway

Online course in Swedish: Betala lön

Your dream, your company, you decide!

Also make the bookkeeping yours.